In this digital era, cash transactions are becoming increasingly uncomfortable for many individuals. Fortunately, NSFAS continuously strives to enhance its services, ensuring easier access for students. As part of their ongoing efforts, NSFAS has introduced a new payment platform to facilitate cashless withdrawals. In this article, we will explore the details of this new offering, providing you with essential information.

How to Withdraw Cashless with an NSFAS Card

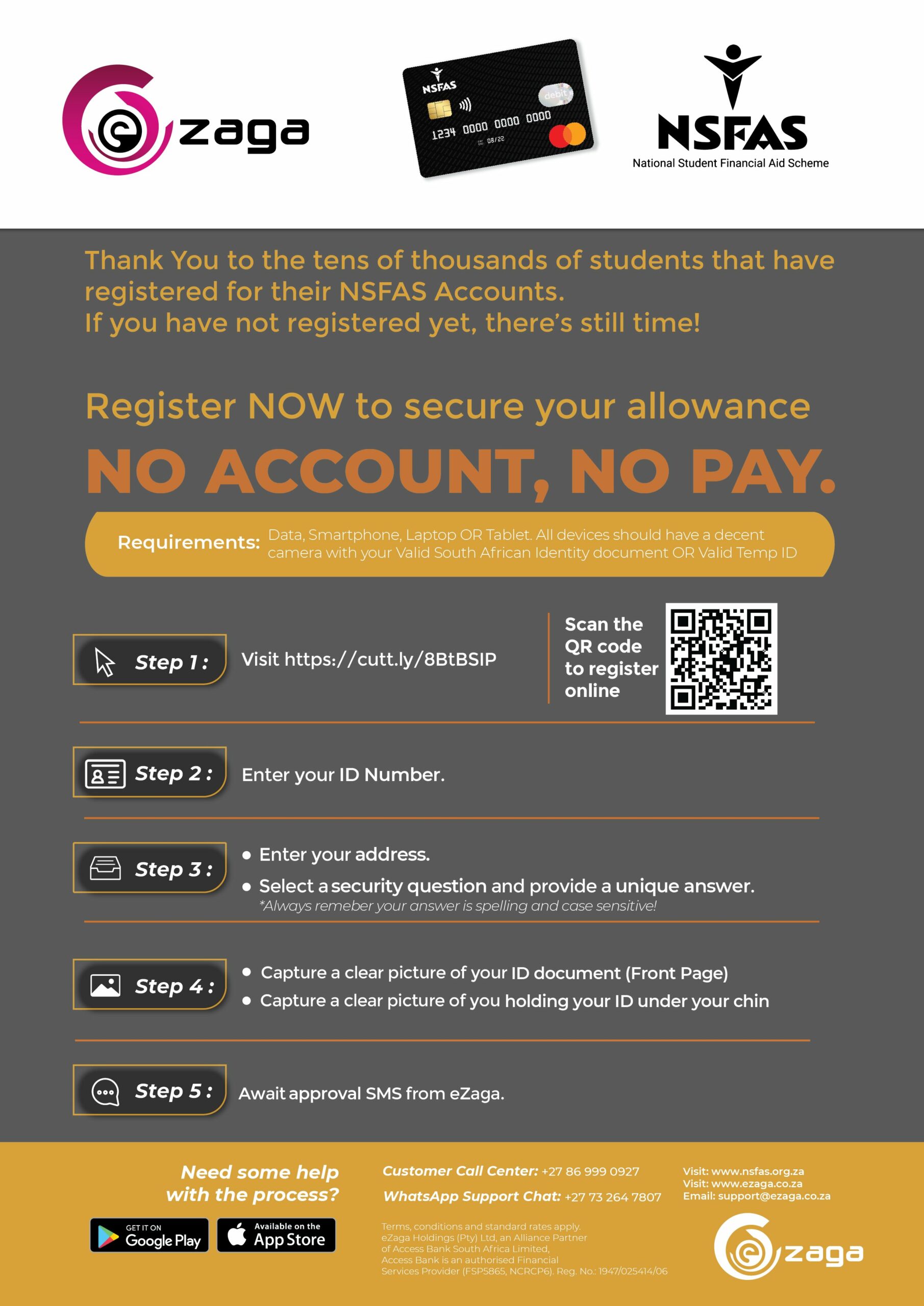

Previously, students receiving an NSFAS allowance for food and study-related expenses could only transact through their eWallet accounts. They had to withdraw cash for their needs. However, a recent update now offers recipients an NSFAS Mastercard, granting them the convenience of cashless withdrawals, along with additional flexibility and benefits. This new system is known as eZaga. Moreover, students can opt for a cardless withdrawal option through an SMS (USSD) code. To utilize this option, simply access the 1347772# prompt on your phone, which is directly linked to your NSFAS account.

To withdraw cashless using your NSFAS card, follow these steps:

- Log in to your eZaga account.

- Select ‘Withdraw Zaga.’

- Choose the Nedbank ATM option or one of the participating stores, namely Pick & Pay, uSave, Boxer, Checkers, and Shoprite.

- Enter the desired amount.

- Within an hour, you will receive a code.

In case you don’t receive the code within an hour, you can use 120001# and select the ‘Get Voucher’ option. The code will be sent to you via SMS, and accessing this service will not utilize any airtime. Additionally, a dedicated call center for this service will be launched soon.

NSFAS Mastercard: Streamlining Financial Transactions

The NSFAS Mastercard functions similarly to any other debit card, with certain features and limitations unique to the NSFAS program. After receiving your NSFAS Mastercard, you will need to activate it by following the provided instructions, which involve calling a customer service number and verifying your identity.

Your NSFAS funding will be loaded onto the card, allowing you to pay for tuition, accommodation, and other study-related expenses. The card can also be used for ATM withdrawals and purchases at merchants accepting Mastercard.

Nevertheless, there are specific restrictions on using the NSFAS Mastercard. For instance, it cannot be used for purchasing alcohol, tobacco, or gambling products. Additionally, non-academic expenses such as clothing and entertainment are ineligible for payment using the card. NSFAS may monitor your spending and request receipts or documentation to ensure the allocated funds are utilized appropriately.

It’s important to note that the NSFAS Mastercard has a shorter expiry date compared to regular Mastercards. Therefore, you will need to apply for a new card each year when eligible for funding. In case of loss or theft, promptly report it to the NSFAS contact center to prevent unauthorized use.

The NSFAS Mastercard aims to simplify the process of accessing funding for eligible students and their related expenses, aligning with the growing trend of transitioning from cash-based transactions to card-based payment options.

Checking the Balance on Your NSFAS Card

While you can still check your eWallet balance using the 134176# SMS code, the availability of the NSFAS Mastercard offers an alternative method similar to checking a traditional bank account balance. Insert your card into a participating ATM, enter your PIN, and select the ‘Check Balance’ option. The ATM screen will display the funds available to you.

Withdrawing Your NSFAS Cash Voucher

As mentioned earlier, you can generate an NSFAS cash voucher through your phone. Additionally, there are circumstances where you may receive a cash voucher from NSFAS. To utilize this voucher, follow the steps below:

- Choose a Boxer, Shoprite, Checkers, Pick & Pay, or uSave store equipped with a Money Market counter capable of processing NSFAS cash vouchers.

- Visit the store with your voucher and a valid form of identification, such as your South African ID or passport.

- Present your voucher and identification to the Money Market cashier, requesting a withdrawal of the funds.

The cashier will verify your details and process the transaction, providing you with the cash amount minus any transaction fees. Several retailers offer zero fees for withdrawals, but remember to keep your receipt as proof. NSFAS cash vouchers have a limited validity period and can only be redeemed at the designated stores mentioned earlier.

This innovative method of managing your NSFAS allowance offers increased speed and convenience. Embracing cashless transactions enables a more streamlined approach to financial management, benefiting students and their educational journeys.

Was this helpful?

1 / 1

#National Student Financial Aid Scheme (NSFAS) #News & Updates