The South African government has implemented various policies and systems to support its citizens in times of need. Two key initiatives include the PAYE (pay as you earn) scheme and the UIF (unemployment insurance fund). These programs aim to provide financial security and assistance to individuals facing unemployment or in need of tax support. In this article, we will delve into the details of these initiatives, discussing how to update PAYE on the UIF database, explaining the differences between PAYE and UIF, and providing valuable information related to registration processes and benefits.

Overview of South African government initiatives

The South African government prioritizes the welfare of its citizens, and this is evident in the comprehensive social security agency established to support individuals in need. Through policies such as PAYE and UIF, the government ensures that financial support is available to those who require it most. These initiatives not only protect vulnerable individuals but also contribute to the development of infrastructure and the resolution of socioeconomic challenges.

The role of PAYE in supporting individuals

PAYE, or “pay as you earn,” is a taxation scheme designed to promote equality among the employed population in South Africa. It requires employees to contribute a portion of their gross monthly salary as tax to the government. This tax is progressive, meaning that individuals with higher incomes pay a higher percentage compared to those who earn less. By implementing PAYE, the South African government generates revenue to fund various public services and support systems.

Understanding UIF and its benefits

The UIF, or unemployment insurance fund, is a crucial requirement in South Africa. This scheme offers short-term financial support to individuals facing unemployment challenges. Although its primary focus is on unemployment, certain qualifications allow individuals to access UIF benefits. To be eligible, employees who work more than 24 hours per month must contribute a portion of their gross salary, while employers also contribute to the fund. UIF provides much-needed financial assistance to those in difficult circumstances.

The difference between PAYE and UIF

While PAYE and UIF are both social security initiatives in South Africa, they serve different purposes. PAYE primarily focuses on the payment of taxes by employed individuals, ensuring that citizens fulfill their tax obligations to the government. On the other hand, UIF is specifically designed to provide short-term financial support to individuals in times of unemployment or crisis. While both programs aim to support South African citizens, the policies, rules, and regulations governing PAYE and UIF are distinct.

How to register for PAYE and UIF

Registering for PAYE and UIF can be a straightforward process for employees. By submitting relevant company details, such as staff size, location, and business profile, to the South African Revenue Service (SARS), employees can initiate the registration process. These details are shared within the systems, and a PAYE number is generated. Once the PAYE registration with SARS is complete, the same details can be submitted to the Department of Labour for UIF registration. Timely registration is crucial to ensure compliance with the law.

Steps to update PAYE on the UIF database

Updating PAYE information on the UIF database primarily falls under the responsibility of employers. However, it is beneficial for employees to understand the process. ensuring personal details are accurate and up-to-date on the UIF database. Updating PAYE on the UIF database involves a few simple steps:

- Access the UIF database through the relevant online portal.

- Verify the authenticity of the portal to ensure the security of personal information.

- Enter the required details, such as the company’s PAYE number and employee information.

- Double-check all information before submitting the update.

- Keep a record of the confirmation or reference number for future reference.

By following these steps, employers can ensure that their PAYE information is updated accurately in the UIF database, contributing to efficient systems and accurate records for the future.

Calculating PAYE in South Africa

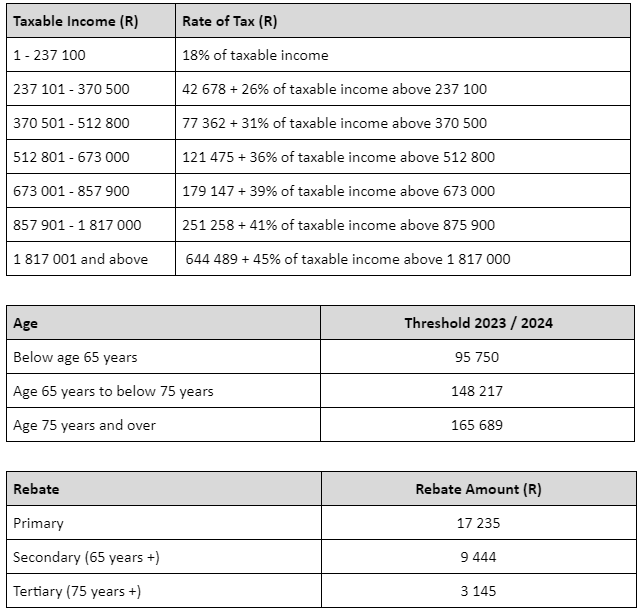

The calculation of PAYE in South Africa depends on the individual’s taxable income and their age. The tax rates are progressive, meaning they increase as income levels rise. To calculate PAYE, two methods are accepted by the South African Revenue Service:

- Periodic Method: This method calculates taxes separately on each payslip, using monthly tax tables based on the monthly income.

- Averaging/Annual Equivalent Method: This method considers the employee’s total income for the entire tax year and calculates taxes using an annual equivalent.

To give you an idea of how PAYE is calculated, let’s consider the example below:

Tax year: 2023

Monthly salary: R 10,000

Employee's age: 30

Assuming no additional deductions or tax credits

By applying the tax rates based on the taxable income and age, the PAYE liability can be determined. Detailed calculations along with relevant tables and thresholds can be found on the South African Revenue Service’s website.

The importance of uFiling for UIF contributions

uFiling is an essential online service provided by the South African government. It simplifies the process of declaring monthly UIF returns and contributions, replacing manual procedures. Employers, including commercial and domestic entities, agents, and tax practitioners, can utilize uFiling to declare and pay UIF contributions, view previous declarations, and receive important notifications.

Submitting details of all employees to the UIF every month is mandatory for employers. These details are used to maintain an employee database for accurate benefit payments in line with the Unemployment Insurance Act. Employers have numerous benefits when using uFiling, including claims submission, requests for payment, viewing claims history, appeals initiation, declaration status, and the ability to verify that returns are up to date.

Using uFiling streamlines the UIF contribution process, ensuring compliance with UIF regulations and facilitating efficient benefit disbursement in times of need.

Benefits of using UIF

The UIF offers several benefits to employees and employers alike. Some key advantages include:

- Short-term financial support during periods of unemployment or crisis

- Peace of mind for employees knowing they have a safety net in uncertain times

- Provision of necessary funds for eligible individuals to cover essential expenses

- Streamlined processes for employers to declare and pay UIF contributions

- Access to historical records for employees, facilitating future UIF claims

- Contribution towards building a robust social security system in South Africa

The UIF aims to alleviate financial stress and provide temporary relief to individuals experiencing unemployment or unforeseen circumstances.

Conclusion

The South African government’s social security initiatives, such as PAYE and UIF, demonstrate their commitment to supporting individuals in need. These programs serve different purposes, with PAYE focusing on tax obligations and UIF providing short-term financial support during unemployment. Understanding the registration processes and how to update PAYE on the UIF database is essential for employers and employees alike. By adhering to these guidelines, individuals can ensure compliance and access the necessary benefits when required. The UIF’s uFiling system simplifies the process of declaring and paying UIF contributions, streamlining operations for employers and facilitating efficient benefit payouts.

FAQs

Q1: Can I update PAYE on the UIF database as an employee? A: While updating PAYE on the UIF database is mainly the employer’s responsibility, employees can familiarize themselves with the process to ensure accurate records.

Q2: What is the difference between PAYE and UIF? A: PAYE is a tax scheme where employees contribute a portion of their salary as tax to the government. UIF provides short-term financial support to individuals facing unemployment challenges.

Q3: How do I register for PAYE and UIF? A: To register for PAYE and UIF, employers can submit relevant company details to the South African Revenue Service (SARS) and the Department of Labour, respectively.

Q4: How is PAYE calculated in South Africa? A: PAYE calculation in South Africa depends on taxable income and age. Progressive tax rates apply, meaning higher incomes are subject to larger tax percentages.

Q5: What are the benefits of using UIF? A: UIF benefits include short-term financial support during unemployment, simplified contributions declaration and payment processes for employers, and access to historical records for employees.

Q6: Can uFiling be used to verify UIF returns? A: Yes, uFiling allows employers to verify the submission status of their UIF returns, ensuring compliance and accurate recording of contributions.

Q7: Are UIF contributions mandatory for employers? A: Yes, employers are required by law to contribute to UIF on behalf of their employees, ensuring they have access to UIF benefits in times of need.

Q8: Are there different tax rates for PAYE in South Africa? A: PAYE tax rates in South Africa are progressive, meaning tax percentages increase as income levels rise. Detailed tables and thresholds are available from the South African Revenue Service.

Q9: Can I claim UIF benefits if I am self-employed? A: UIF benefits are primarily designed for employees facing unemployment and therefore do not typically apply to self-employed individuals.

Q10: What happens if my employer fails to update PAYE on the UIF database? A: It is crucial for employers to update PAYE on the UIF database to ensure accurate information and seamless processes. If an employer fails to update this information, it may result in delays or difficulties when claiming UIF benefits.

Was this helpful?

0 / 0

#Department of Employment and Labour #News & Updates #South African Revenue Service (SARS) #Unemployment Insurance Fund (UIF)